Deferred Income Double Entry

ABC assumes to spend CU 3 000 in 20X2-20X5 and CU 2 000 in 20X6 CU 14 000 in. Deferred revenue is listed as a liability on a companys balance sheet.

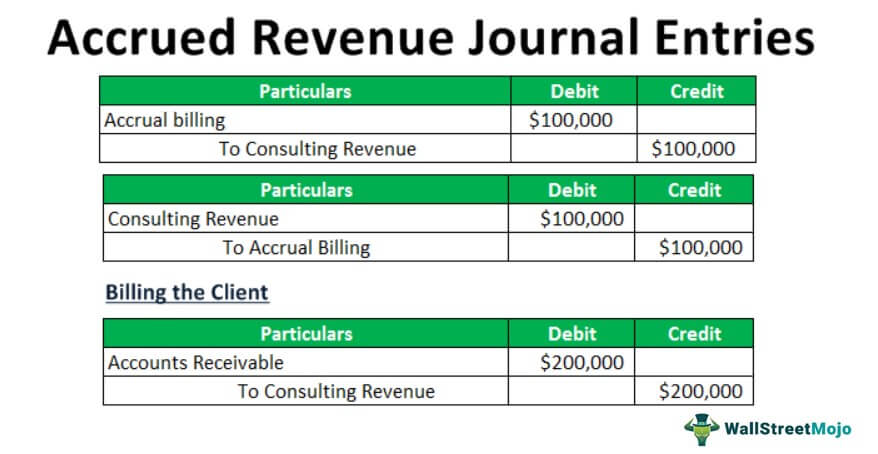

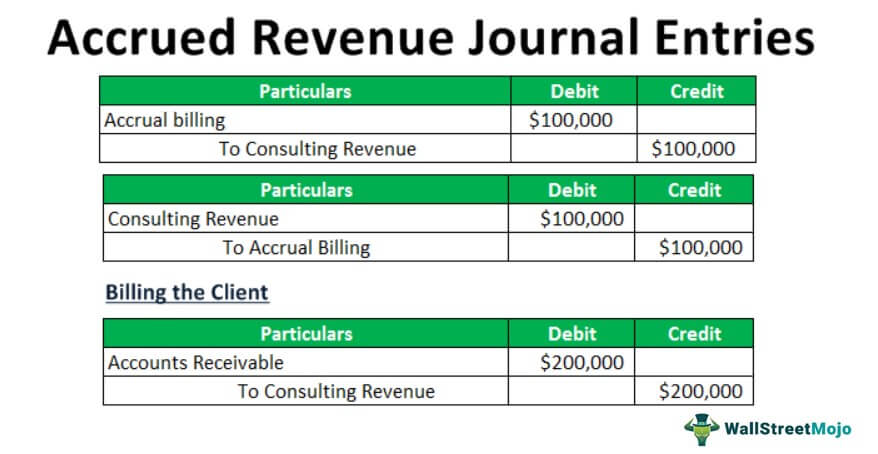

Accrued Revenue Journal Entries Step By Step Guide

The balance on the deferred tax liability account is 150.

. Receiving a payment is normally considered an asset. In this journal entry the company recognizes 500 of revenue for the bookkeeping service the company has performed in. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Grant of CU 10 000 to cover the expenses for ecological measures during 20X2 20X5. New Look At Your Financial Strategy. In this situation you record the deferred revenue as a long-term liability on the companys balance sheet.

You will record deferred revenue on your business balance sheet as a liability not an asset. First we have to calculate the income tax expense. This represents a good or service that the business still owes to the customer and if the business.

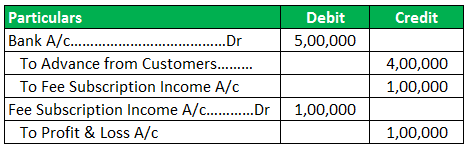

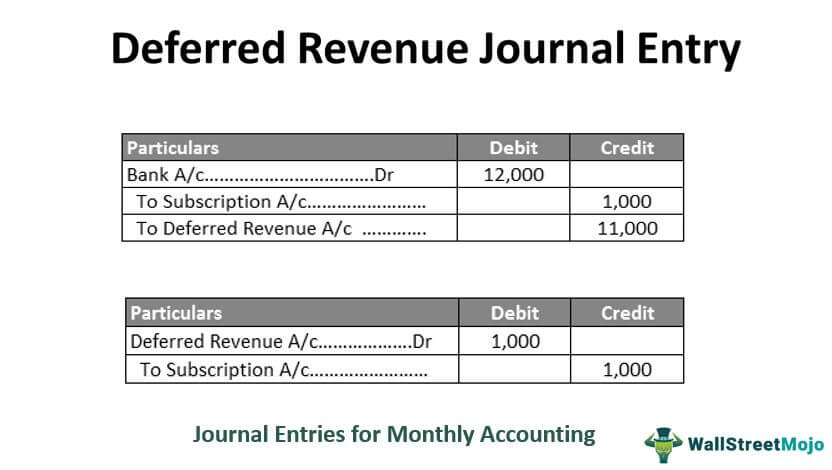

The concept is commonly applied to the receipt of money. So our double entry becomes Dr Cash 20 Cr Deferred Income 20. But prepayments are liabilities.

Based on accounting principles we have to match revenue and expense. Income tax expense accounting profit tax rate 50000 20 10000. The next step is to.

What is the double entry for accrued income. Visit The Official Edward Jones Site. The income tax payable account has a balance of 1850 representing the current tax payable to the tax authorities.

Record the amount paid by the customer. Then at the end of year 1 we can release a quarter of this. As a liability the recorded deferred gains are listed on the right side of the balance sheet equation in liabilities.

Tax as per books should be same 12000. Please prepare a journal entry for the deferred tax liability. The following journal entry must be passed in year 1 to recognize the deferred tax.

The double entry for this is. In year 1 12000-6000 6000. Deferred income is an advance payment from a customer for goods or services that have not yet been delivered.

The journal entry is debiting deferred. Instead we should set up a deferred credit account. We have to record them as assets and amortize them over the period of 3 years.

First Intuition Accrued And Deferred Income Youtube

Deferred Revenue Journal Entry Step By Step Top 7 Examples

No comments for "Deferred Income Double Entry"

Post a Comment